Personal Finance gets the gold

November 17, 2017

By SYDNEY CLARK

The Mirror reporter

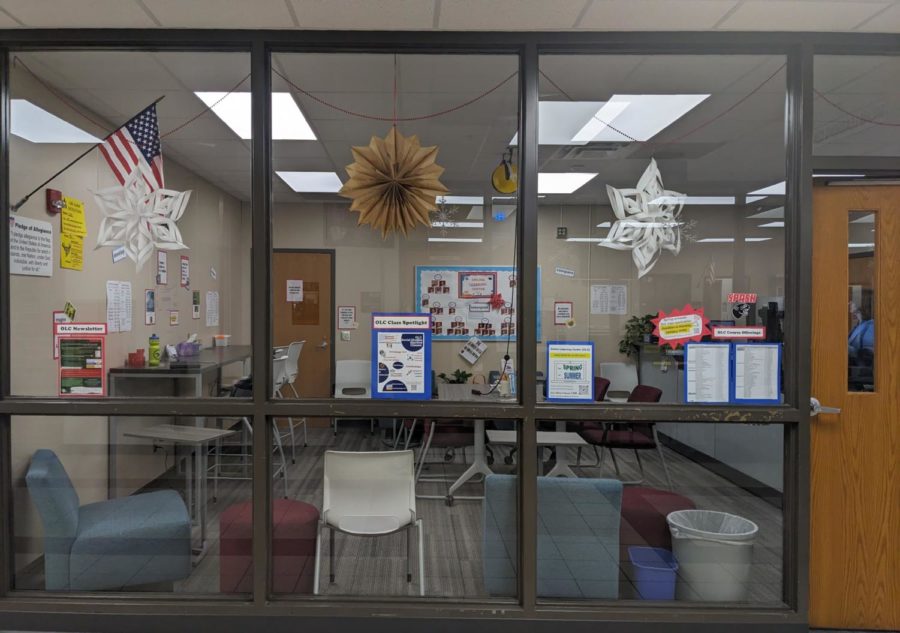

Athletes may be honored for their prowess with a gold medal, but Stevens Point Area Senior High’s (SPASH) personal finance classes have been honored with a gold standard.

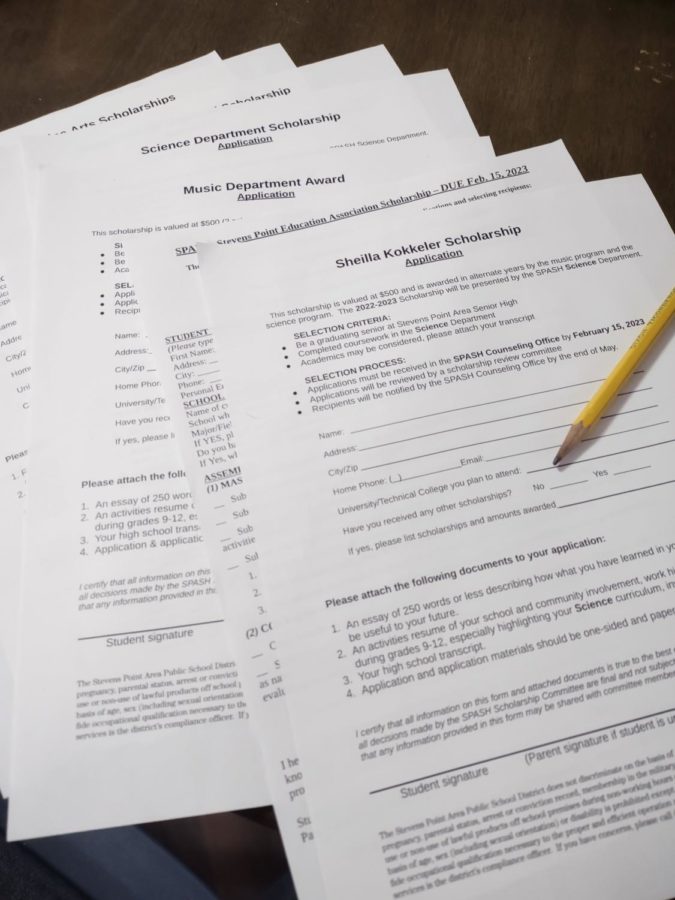

Next Generation Personal Finance (NGPF), a non-profit organization, evaluated personal finance programs at over 11,000 high schools across the nation. SPASH received a NGPF Gold Standard for “commitment to educating all students in 21st Century personal finance skills.” SPASH is one of only 600 schools to receive the honor. To receive a Gold Standard a school needs to require students to take a class solely dedicated to personal finance.

Personal Finance teacher Brent Gostomski said, “ Students from gold standard schools are more likely to save a rainy day fund, less likely to max out credit cards and more likely to pay off credit cards in full.”

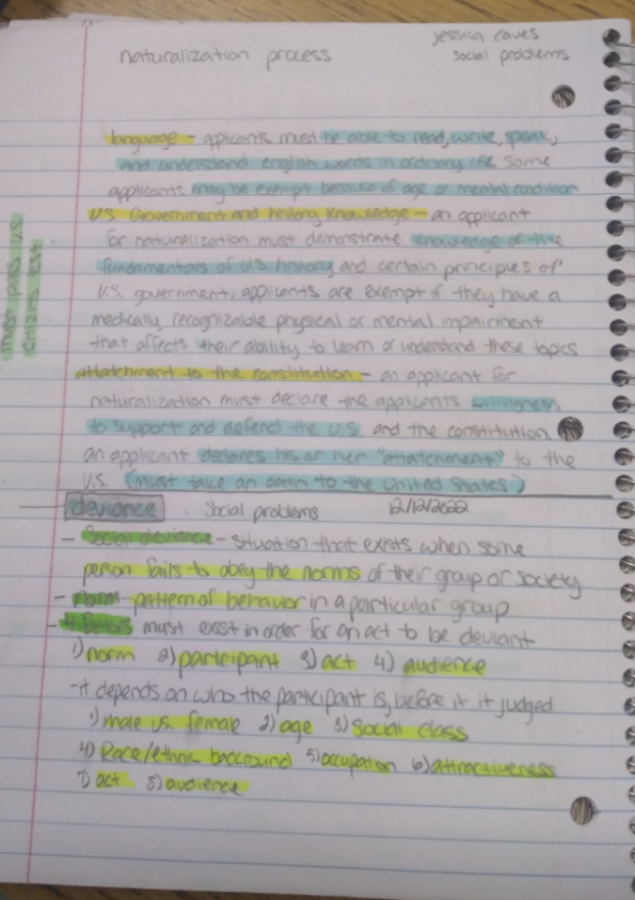

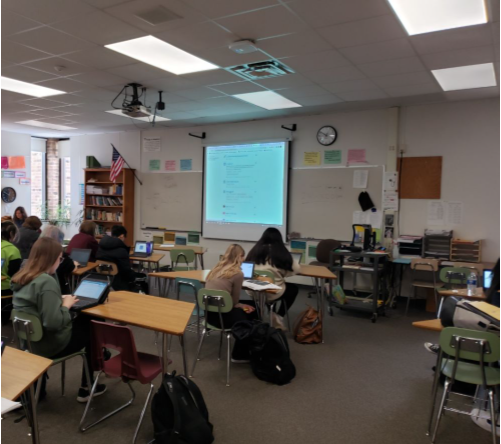

The Stevens Point School District mandates a half credit of personal finance for graduation. Personal Finance can be taken online during the summer or school year, or in a traditional classroom setting, for a semester.

Emily Seppelt said, “I took it over the summer online, so I didn’t have to take it during the school year. It was convenient and worked around my schedule well.”

The class curriculum involves creating a budget, retirement and savings plans, banking and credit. The class teaches how to be financially secure and manage money.

Former Personal Finance student Jenna Boech said, “The most valuable thing I learned was probably investing” and the importance of budgeting money at a young age. “Personal Finance is important because it teaches you valuable real life things that you’ll always need.”

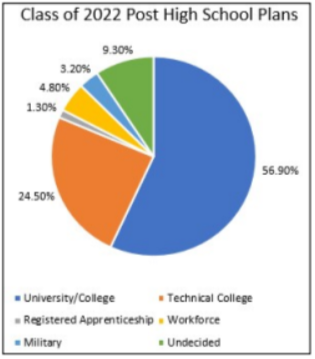

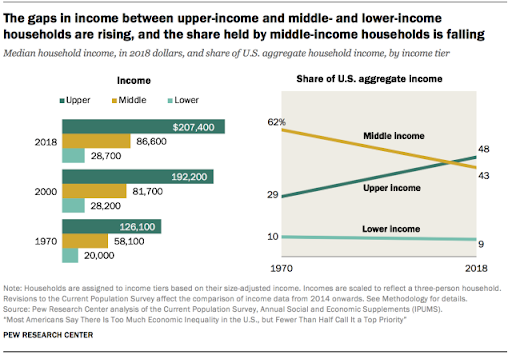

The current status of financial health in America is not good. As of 2016, The United States is ranked fifteenth in the world in financial literacy with only 57 percent of the population financially literate. The total student debt is $1.5 trillion and the total national credit debt is $882.6 billion. Only about half of high schools across the nation offer a standalone personal finance class, and only around 16.4 percent of students nationwide are required to take a personal finance course according to NGPF.

The goal of NGPF is to “make sure every student in America gets a personal finance education” according to Tim Ranzetta, NGPF’s founder. They hope to do this by influencing policymakers to require a personal finance class for graduation and by using tax dollars to fund the programs. Gostomski said, “Before they graduate, students must learn to manage money, create budgets and build good credit habits to become financially responsible adults in the real world. Without learning these skills in school, they often learn them through trial and error with lasting consequences.”

Arianna Zuber • Dec 14, 2017 at 1:54 PM

I agree, SPASH offers a really good personal finance class for the students. I think it’s really cool that we got honored with a gold standard for that class.

Joey Kwong • Dec 14, 2017 at 11:08 AM

This is quite an interesting article. I never knew that the financial literacy in America was so bad. It is rather disappointing to know that though we are one of the most prosperous countries in the world, we have such a high national debt. However, it is very comforting to know that SPASH has such a prominent personal finance program. I have definitely benefited from it myself and know that many others have as well!