Better Future Through Finance

January 18, 2023

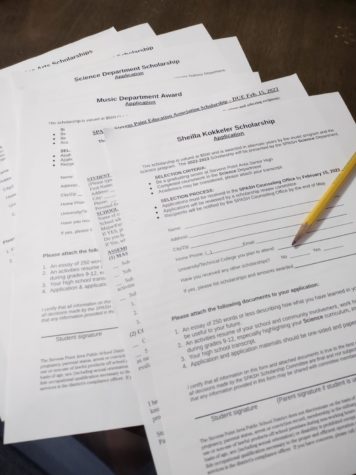

Imagine it’s your first year on your own, it’s April 14th, tomorrow is the last day to file your taxes. You haven’t even begun to get started. Your high school did not offer personal finance/business classes. At SPASH, 0.5 credits of finance is required to graduate. Some topics within the course are budgeting, taxes, finding apartments, how to save and invest, retirement planning, debt management, etc. Personal Finance/Business classes are beneficial to students later on in life, and should be required for high schools in Wisconsin to provide to their students.

Investing in important classes

Personal finance/business classes teaches important information for your future. Mr. Castleberg, Finance teacher at SPASH, states that he hopes students retain this information from his class, but is well aware that just like any other class people will forget some things. In other words, he is well aware that students may not remember every single detail on how to manage your money, but knows that taking this class gets you that much closer to success.

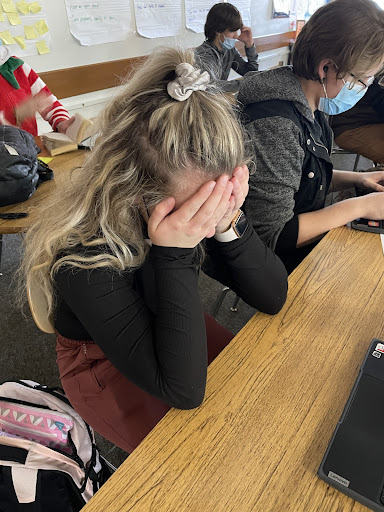

Lake Glodowski, Junior at SPASH states, “I can’t do my taxes, I don’t know how to do them.” He has not yet taken a finance class. Some students who are near the end of their semester on their finance class, like Zach Anderson, junior at SPASH, says the opposite when asked about if he knows how to manage his money. When asked the question, “Do you feel more confident financially, post taking this class?” He states, “yes, I know how to file my taxes, I know how to set a budget, and how to properly save my money.” In other words, prior to taking this class he wouldn’t (along side of all of us) have known how to begin for most if not all of the things he listed.

Mandatory Money Savings

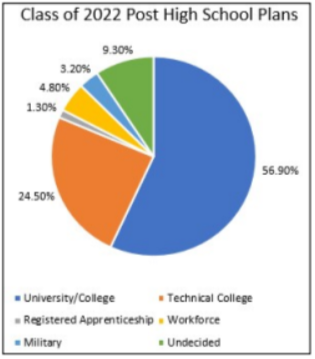

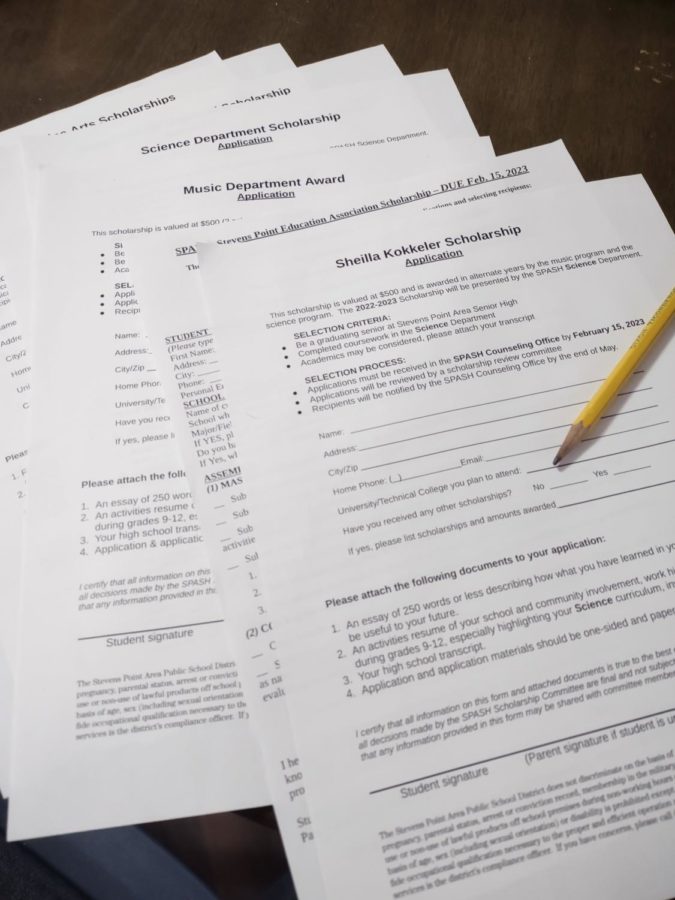

Should personal finance/business classes be mandatory? Mr. Castleberg argues that Personal Finance/Business classes should be mandatory prior to college. He states, “… it is one of the only few classes that students will for sure use after high school/college.” In other words, while other classes may teach useful information some of us may need, depending on your profession you will not need all these classes we’re required to take. Personal finance/business is one of few classes students can and will for sure use in their future. Only 48.3% of Wisconsin students are given the “Gold Standard, [a guaranteed finance class].” This means that over half the students in Wisconsin are not guaranteed to be educated about how to manage their money properly. The high school Mr. Castleberg attended did not offer personal finance classes, he wishes they did so he could have avoided making some mistakes he had.

Knowledge in Debt

On the other hand, some people would argue that they could learn these topics through family or figure it out on their own. People who believe this argument may say it would be easier for them to learn it themselves, rather than spending one or more semesters taking this course. With that being said, although, when people attempt to teach themselves these type of life skills they are more prone to make mistakes. According to CNBC, “Studies show that students who take personal finance courses … have better average credit scores and lower dept.”

In other words, finance classes would be greatly beneficial to students and has been proven.