Bringing the After High School Financial Struggles Out of the Dark

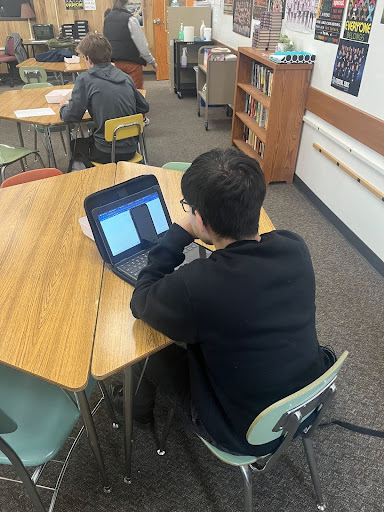

Photo of necessities after high school made by Brooklyn Pagel

December 19, 2022

Imagine you’re so excited to graduate high school; you’ve waited 13 years for this moment. You graduate and live your best summer and then it dawns on you. You don’t know what to do? You want to move out but you didn’t think you had to save money. Therefore you go and live in dorms and just add it on to your student bills. You didn’t realize though living in the dorms you still have expenses you didn’t know about. No matter what you do after high school you need money. The world revolves around it. You feel you weren’t taught all of these basic concepts to live on your own. The guilt of not saving money and not doing research before going on your own is consuming you. Students are split between whether they are financially ready for after high school or not; It’s weighing heavily on SPASH students recently.

SPASH Classes

Classes at SPASH are designed to help students succeed after high school. Ms.Lucas, a Personal Finance teacher at SPASH, praises that her class is mandatory for all students. “I often get positive feedback from students while taking the course…they become very engaged in the topics we cover in class and say what they are learning is extremely helpful.” In other words Ms.Lucas receives feedback from her students that boosts herself up and really shows what she’s teaching has a purpose. On the flip side, a student and teacher’s perspective is different. A teacher is only trying to get the students to understand the topics while a student is the one trying to take in all the information. A survey conducted of 55 SPASH students in November of 2022 maintains the argument that classes at SPASH are helping the students. 50.9% of students who took the survey said that SPASH has prepared them for after high school. On the flip side that means 49.1% of the students believe that SPASH has not. To say the results are close is an understatement. Everyone has their own opinion at SPASH on if they helped or not but the ones who are saying they need more help where can they get the extra support they need?

Seeking Help is Easier Said Than Done

Students’ urge to move out is potentially slowed by unknown monthly expenses and obstacles. Nadia Lind, a senior at SPASH, says that she doesn’t know whether she wants to move out because she has so many pros and cons to take into consideration but fears she won’t be financially stable and has to seek help from her parents. To add on to this, students at SPASH, especially seniors who need to be actively thinking about choices like this are fearing for their futures because of inflation right now making everything more expensive there, doubting their abilities to be financially stable. As seen in the survey conducted of 55 SPASH students 72.7% of students said they do not know what they need for monthly expenses after high school. Thus, the majority of the students that took the survey said they don’t know what they are going to need for monthly expenses after high school. That is a landslide of students who don’t know what all of their expenses are and not even including the hidden monthly expenses. Most kids’ dreams are to move out right when they turn 18 because they finally have the freedom to do so, but when you get to the age you really don’t know what to do and don’t know the expenses you’re willing to take on and that is scaring teenagers away and setting themselves up for disappointment.

Fearfully Moving Forward

The fear of not having the resources to financially support themselves weighs heavily on students. According to the survey, 58.2% of SPASH students who completed the survey are going to a four-year college. Over half are devoting 4 or even more years going to a college with barely any income coming in. To follow up on this, over half of the students who took the survey are going to a four-year college and right now those are the most expensive colleges to attend. During this it is very difficult to work and the most you can really do is part time. If students can only work part time and have to afford other necessities like food how can they afford technology and supplies they need for college? This should be taught in school but is only breezed by in class. As shown in the survey conducted by Junior Achievement “…teens planning to pursue a four-year degree, two thirds (66%) also expressed concern about having the technology needed to complete a degree.” To elaborate, colleges don’t provide the necessities to complete a degree like technology and a lot of teens cant afford to buy the expensive technology to be able to successfully complete assignments.

To wrap this whole idea up students fear for their futures after highschool. They worry about if they are going to be financially stable through college and even if they don’t go to college. With prices constantly rising, it puts more and more fear in high school students’ heads. One possible solution is to offer personal finance at every grade. The personal finance offered in high school is a very good resource for students but it’s all too much to fit into 2 quarters. Offering it throughout the school years will really build a good base for students when they graduate. SPASH teachers are trying all they can to help students but towards the end it’s all too much to cram into one year.