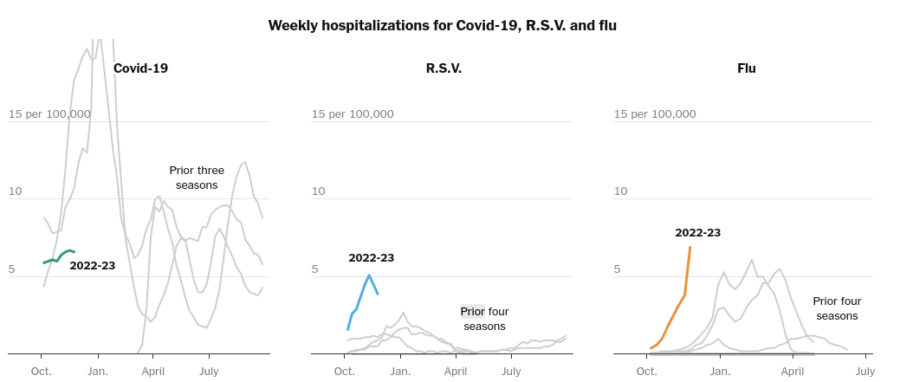

Many people think about going to college, but few think about the costs before making the decision to go. Not knowing how you will pay for college can end up affecting you financially for the rest of your life. On average it takes about 10 years for most people to pay off their student loans. This is an important reason to start planning and saving for college as early as possible. College is currently seeing an increase in price of almost 4% from year to year. This means that the price is only going to continue to go up! Planning for how you will pay for college, now while you are still in high school, can be a very important step to getting a head start in saving and making sure you have a plan to cover the cost.

Many people don’t have a plan of how they will pay for college until it’s too late. George Kamel, a member of the Dave Ramsey show says, “The cost of attendance includes tuition and fees, housing and food, books and supplies, transportation and other personal expenses for full-time undergraduate students. Also, these numbers don’t take inflation into account. So, 18 years from now, the rates will likely be much higher.” Taking this information into consideration will not only allow you to see how much college costs now, but to also consider the impact of inflation when projecting what the cost might be when you are ready to attend. Understanding the future cost of college can be beneficial when seeking resources and planning to avoid additional stress due to unanticipated increased costs.

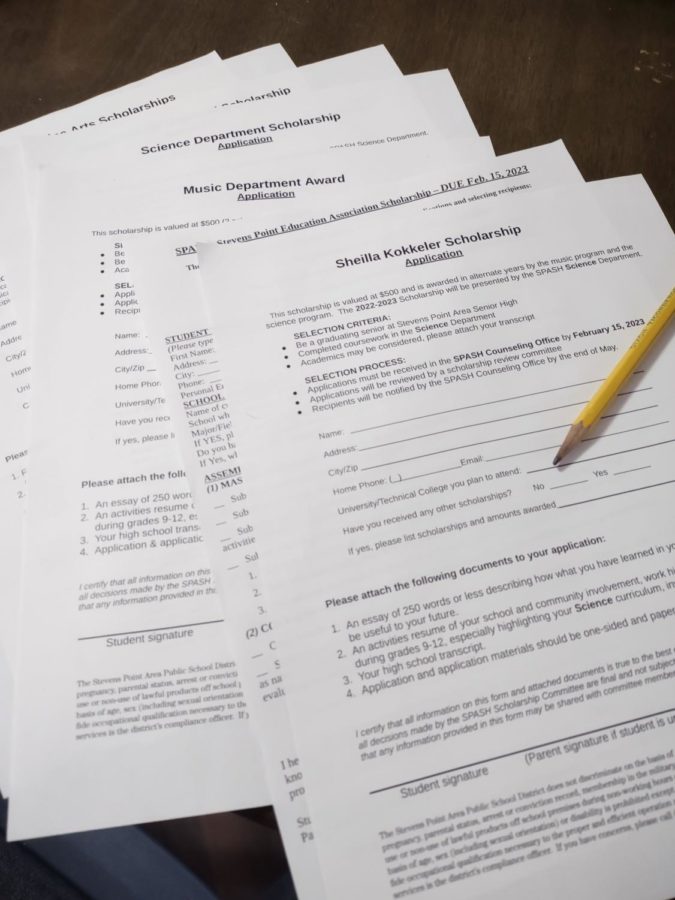

To plan for increased costs, you will want to start saving extra money. There are many ways to do this, one possible way is by working a part time job. The online college planning guide, Big Future states, “If you’re a student who works, you can set aside some of your earnings to help with your tuition or other college costs.” Working a part time job is one of the most popular ways to save some money for college. Another way to save money is to apply for scholarships. By writing an essay explaining the reasons why you should be selected to receive the scholarship, you have the chance to receive money to offset the cost of your tuition. Scholarships are helpful in paying for college because it is additional money you didn’t have to save and don’t have to pay back.

When selecting a college to attend, the cost of tuition can oftentimes be a deciding factor on whether it is a reality. While many people may grow up dreaming about attending a specific college, going to that dream school may not always make the most sense financially. Gayle Schiszik, who attended both the University of Minnesota and UWSP, found herself having to make this decision when she was in college. Was it worth staying at the school she dreamed of going to, the Division 1 Big 10 school in Minnesota, or going back home to attend UWSP? Gayle says that “UWSP was home and familiar, whereas Minnesota was everything I envisioned my college experience to be.” However, after a few years and changing her degree she was able to see the significant financial benefit of transferring back to UWSP. Considering the cost of living in addition to tuition can make a big difference in the overall cost of college.

Being able to pay college expenses is possible for anyone with the correct saving and planning. Getting ahead and saving as early as possible is the most important and is what makes being able to afford going to college possible.