Types Of Financial Aid

January 22, 2021

Many students may be looking to apply to some sort of future schooling, however, they know that the amount of money needed to attend might be far more than they currently have. With college being so costly it can be difficult as a young student to afford all the expenses. This reason is why so many students apply for the Free Application for Federal Student Aid (FAFSA) each year. In order to sign up to acquire financial aid it is important to know all of the options available.

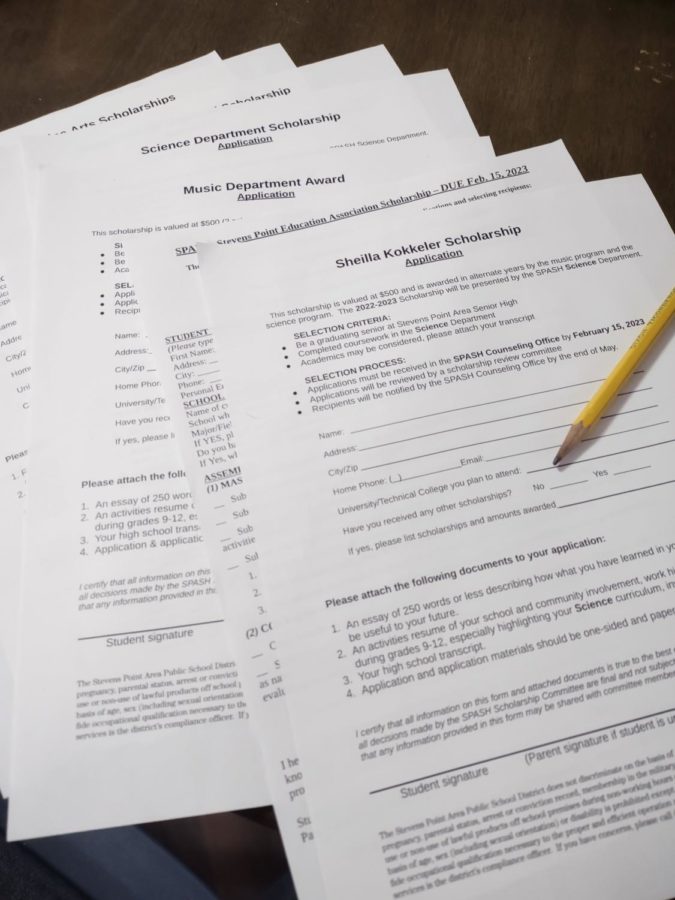

Scholarships are one type of financial aid that can be very beneficial in regards to helping students afford schooling. Although, while everyone may be able to find a scholarship, not all would fit the requirements. According to an article called, ¨Understand Financial Aid¨, scholarships are, ¨Free money that is based on academic or other achievements, or on financial need, to help pay for school.¨ In order to receive a college scholarship certain standards must be reached. There are many different types of scholarships available that can be applied for. If any are eligible for you it would be wise to look into applying for one as it can slightly or even significantly lower the costs given. Jill Nemeth, the Career Center Advisor of Stevens Point Area High school, goes over the deadlines that are implicated in order to sign up for a scholarship. ¨It is a busy time with local scholarships. The Community Foundation of Central Wisconsin scholarships are due February 15. There are numerous scholarships listed on the SPASH web page. Scholarships are divided by the month they are due. Take note of deadlines and check these often from now through the end of the year.¨ This is why it is very important to research certain scholarships available as missing the opportunity to reduce the costs of an education would be very unfortunate.

Another form of financial aid would be a Loan. A student loan is money that can be accepted to help afford a form of education at the time that will have to be paid back later. Loans can greatly affect a person’s future as it is borrowed money, and so it must be repaid. A loan is a legal obligation, therefore, in the future it is something that will be taken out of the salary of the person who applied for one. This should not have to be such a high amount after graduation that it is not worth it in the long run. For this reason it is better to take out a smaller loan so as to not be so overwhelmed later on. Loans require a lot of understanding of the terms and responsibility of making payments on time.

Next there are work-study jobs. This too is a type of financial aid. Work-study is an on campus job. There are different types of work-study jobs. Federal work-study is a program that tries to give students a job that relates to their course of study. It is similar to a regular job in multiple ways, besides the fact that the money is being earned through the school the student is connected to. In the same article, ¨Understand Financial Aid¨, it says, ¨How you’re paid depends partly on whether you’re an undergraduate or graduate student.¨ It goes on to explain how typically students are paid by the hour, but if not they are required to pay the student at least once a month. Going for a work-study job means the student will at least be paid the federal minimum wage, though, depending on what type of work they are doing the amount of money they make could increase. As it sounds, work-study jobs are closely related to normal jobs and are a good way to earn money to pay off college debt.

The last kind of financial aid available would be grants. Grants are money that a student can apply for if it is something that they greatly need. It is also not necessarily something that has to be paid back. If a student is going to four-year colleges, universities, community colleges, and career schools a grant could be provided. Being eligible to receive a grant can differ depending on the program that student is involved in. Jill Nemeth, the Career Center Advisor said regarding eligibility, ¨According to the National Center for Education Statistics, over 86% of first time undergraduate students (2017-18) were awarded financial aid.¨ She goes on to explain the types of things FAFSA takes into consideration, ¨wage information from tax documents, how many people live in your home, and marital status.¨ In order to be accepted for a certain type of financial aid, for instance, a grant, you need to have the things they are looking for.

School may be very difficult to afford. This is why there is so much value in looking deeper into each option of financial aid out there. It is likely there is some type of financial aid that can help benefit someone and they did not even know about it. College is expensive, so it is very convenient there are scholarships, loans, work-study jobs, and grants out there to help cover some of those costs. Jill Nemeth explains it here, ¨Every scholarship is different regarding the eligibility requirements. Leadership, academic achievement, community service, extracurricular activities or your major may be taken into consideration when you apply. If you meet the eligibility, apply!¨